Thematic brief: Leveraging equity finance to scale up climate innovation & investment

Thematic brief: Leveraging equity finance to scale up climate innovation & investment

Over the past decade, blended finance – which uses public funds to share risk and crowd-in private investment through co-financing - has usually taken the form of relatively safe senior debt rather than more risky instruments such as equity or guarantees that could have higher leveraging ratios and better meet the needs of private investors to finance the emergence, deployment and widespread adoption of new climate solutions.

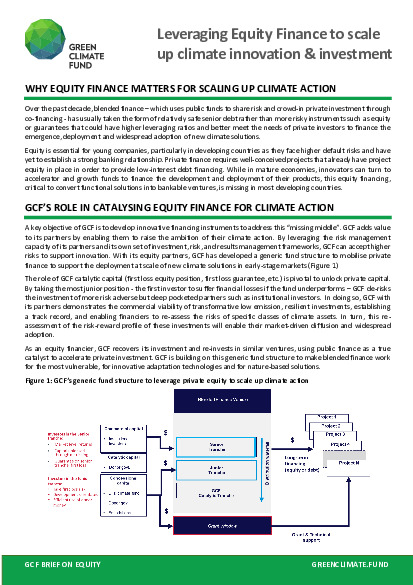

Equity is essential for young companies, particularly in developing countries as they face higher default risks and have yet to establish a strong banking relationship. Private finance requires well-conceived projects that already have project equity in place in order to provide low-interest debt financing. While in mature economies, innovators can turn to accelerator and growth funds to finance the development and deployment of their products, this equity financing, critical to convert functional solutions into bankable ventures, is missing in most developing countries.